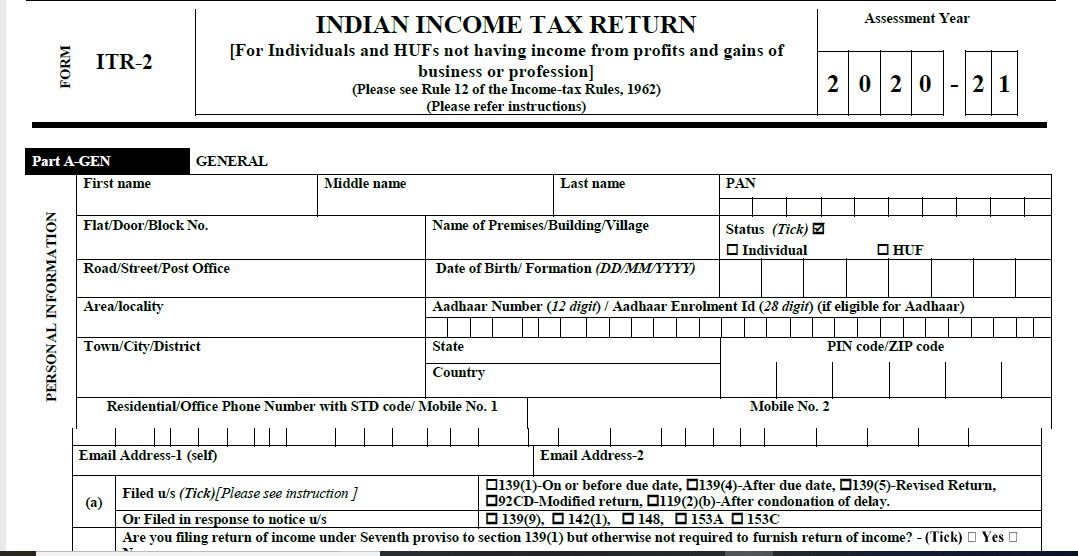

TDS deducted on cash withdrawals exceeding Rs 1 crore (Rs 20 lakh in certain cases) If provisions of Section 194N of the Act are applicable i.e. Taxpayers who hold assets outside India Those who have income from any other source, e.g., more than one house property, capital gains, profits or gains of business or profession, winning from lottery Having brought forward losses or losses to be carried forward under the head ‘income from house property’ Those who hold investments in unlisted equity shares Ordinarily residents having total income of more than Rs 50 lakh

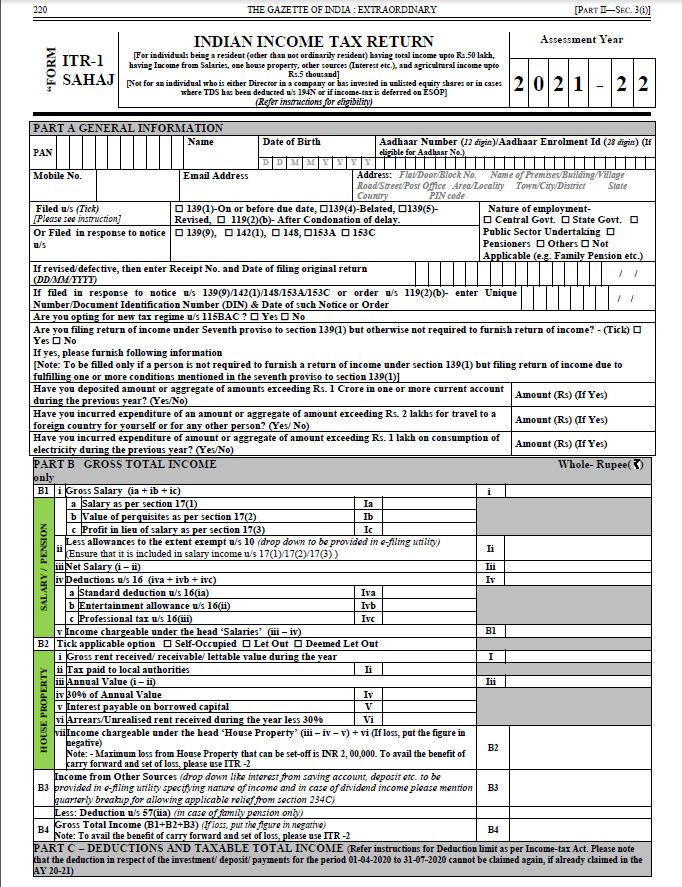

Non-residents or residents but non-ordinarily residents Individuals qualifying as ordinary residents can only file ITR 1 form. Those who have agricultural income of up to Rs 5,000, can also use Sahaj form for filing income tax return. Taxpayers can also file ITR 1 for the income from other sources such as interest from bank deposits or one house property. It must be mentioned salary also includes pension. ITR 1 form or Sahaj is applicable for salaried individuals with total income of up to Rs 50 lakh for the financial year 2021-22. It is important for the taxpayers to know the correct type of ITR form applicable to them.ĭo not get confused about which form to choose while filing income tax return. There are multiple ITR forms available for the taxpayers for various sources of income.

July 31 is the last date for filing income tax return (ITR) for the assessment year 2022-23 or financial year 2021-22.

0 kommentar(er)

0 kommentar(er)